Card Dealing

Don't add to your after-college debt by loading up on credit cards.

Don't add to your after-college debt by loading up on credit cards.

When Colette was a sophomore at Oberlin College, she received her first credit card.

“I was very excited, ” she says. “Unlike a lot of my friends, I wasn’t being supported by my parents. I also had a job, so I figured I was entitled to use my credit.”

Colette did use her credit card – a lot. She bought spring break vacations to Jamaica, dinners for friends, CDs and books. She was soon offered another credit card, which she also accepted. “I never missed a payment, but I never paid anything off either, ” she says. “I just kept getting more offers and moved my credit around from card to card.”

By the time she graduated from college, Colette owned four credit cards and had racked up nearly $20, 000 in debt. Because her debt was so high compared to her income, her interest rates had also climbed – from an initial 9.9 percent to 27 percent.

After college, Colette and her new husband, who was attending law school, used their credit cards to bridge the gap between loans and expenses. “We owed nearly $50, 000 in credit card debt alone, ” she says. “And we panicked when we realized that we weren’t going to be able to make our minimum payments anymore.”

Getting Into Debt

A recent study conducted by Nellie Mae, the nation’s leading student finance firm, revealed that the average undergraduate carries a credit card balance of $2, 169. According to the study, many students use their cards without anticipating how the bills will be paid off. It also showed that many students use their cards for tuition and books, which can be more effectively paid for with a student loan.

“Acquiring a student loan takes planning, ” says Nina Prikazsky, vice president of operations for Nellie Mae. “Student loans are much more flexible for interest rates and payment than credit cards. [But] some students just never look ahead.”

One cause of credit card debt is college students’ difficulty in adjusting to their newfound financial independence. “They are used to their parents paying for everything, ” says Seth Charnes, a Chicago-area CPA. “There are students walking around with $300 cell phone bills who don’t have jobs, and they don’t understand why that is a problem.”

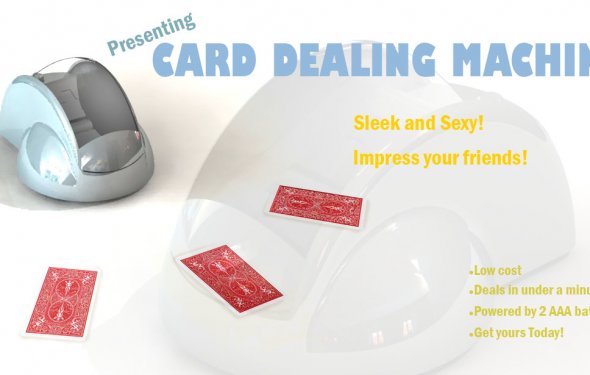

A card game is any game using playing cards as the primary device with which the game is played, be they traditional or game-specific. Countless card games exist, including families of related games (such as poker). A small number of card games played with traditional decks have formally standardized rules, but most are folk games whose rules...

A card game is any game using playing cards as the primary device with which the game is played, be they traditional or game-specific. Countless card games exist, including families of related games (such as poker). A small number of card games played with traditional decks have formally standardized rules, but most are folk games whose rules...