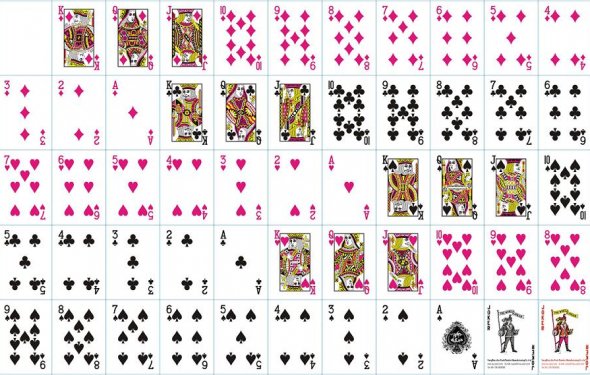

Cards face

If you’re looking to transfer a credit card balance, the Citi® Diamond Preferred® Card and the Citi Simplicity® Card both offer lengthy promotional APR periods, the same annual fee and the same balance transfer fee. Picking between the two means weighing the Citi Simplicity® Card’s absence of late fees and penalty APR against the Citi® Diamond Preferred® Card’s dedicated concierge service. Let’s dive in.

If you’re looking to transfer a credit card balance, the Citi® Diamond Preferred® Card and the Citi Simplicity® Card both offer lengthy promotional APR periods, the same annual fee and the same balance transfer fee. Picking between the two means weighing the Citi Simplicity® Card’s absence of late fees and penalty APR against the Citi® Diamond Preferred® Card’s dedicated concierge service. Let’s dive in.

Citi Simplicity® Card: No late fees

Off the bat, the Citi Simplicity® Card comes with a promotional APR of 0% for 21 months on purchases and balance transfers, and then the ongoing APR of 12.99% - 22.99% Variable . With one of the longest promotional periods available, this card is a worthy contender for anyone trying to finance a large purchase or gain some time to pay off a balance from another card. Of course, if you are transferring a balance, be sure to factor in the card’s transfer fee: $5 or 3% of the transfer amount, whichever is greater.

Nerd note: Most balance transfer cards require making at least the minimum payment to maintain the 0% APR period. Be sure to check your card’s terms and conditions for specific coverage details.

This card does not charge late fees or a penalty APR, which is fairly uncommon. Although we always recommend making your payments on time, with the Citi Simplicity® Card, if you find yourself in a bind, you won’t face any issuer-added penalties.

With an annual fee of $0*, this card is a solid choice if you’re looking for a balance transfer card that won’t ding you for late payments.

Citi® Diamond Preferred® Card: Concierge convenience

Similar to the Citi Simplicity® Card, the Citi® Diamond Preferred® Card comes with 0% for 21 months on purchases and balance transfers, and then the ongoing APR of 11.99% - 21.99% Variable . This option makes it another good candidate as a balance transfer or purchase financing card — but, again, be sure to keep the card’s transfer fee in mind: $5 or 3% of the transfer amount, whichever is greater. And like most cards, the Citi® Diamond Preferred® Card does come with late payment fees and a penalty APR.

One convenience this card offers that the Citi Simplicity® Card does not is 24/7 concierge service. This perk can help you book travel, make restaurant reservations and purchase event tickets, among other things. If you prefer delegating these often tedious tasks to your card issuer, the Citi® Diamond Preferred® Card has you covered.

Like the Citi Simplicity® Card, this card also has a $0* annual fee. So if you’re willing to exchange late payment fee protection for the services of a concierge, the Citi® Diamond Preferred® Card might just be the card for you.

Perks offered by both cards

A handful of useful features come standard with both cards. Both include the coveted Citi Private Pass, which gives cardholders presale and VIP access to events such as live music, sports, dining and family entertainment. Access to the pass could mean not missing out on your favorite band or that Broadway show you’ve been dying to see.

Travel benefits that come with these cards include EMV-chip technology, worldwide rental car insurance and 24/7 emergency assistance. However, both cards do come with a foreign transaction fee of 3%, so you may want to seek other options if traveling is your goal.

In a deck of playing cards, the term face card is generally used to describe a card that depicts a person. Cards depicting persons were developed in Europe, possibly in the late 14th century; it is believed that earlier sets of cards included "court cards" that showed abstract designs instead of people.

Europeans changed the court cards to...

|

Double Face Cards (Bicycle) Toy (SportsMarket)

|

|

Bicycle Poker Standard Size Jumbo Face Index Playing Cards Blue and RED Color- ONE Dozen (12 Pack) Toy

|

|

Pathfinder Cards: Pathfinder Society Face Cards Deck Book (Paizo Publishing, LLC.)

|

|

Gentlemans Club Face Coaster Toy (Paladone Product - Toy)

|

|

60cm Grey/White Balance Card Double Face Sides Focus Board for Photograph Photography (Neewer)

|